Ace Info About How To Apply For S Corp

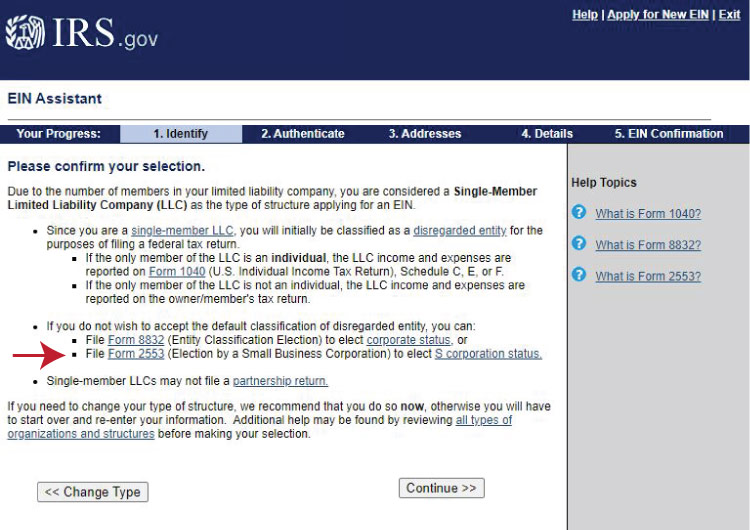

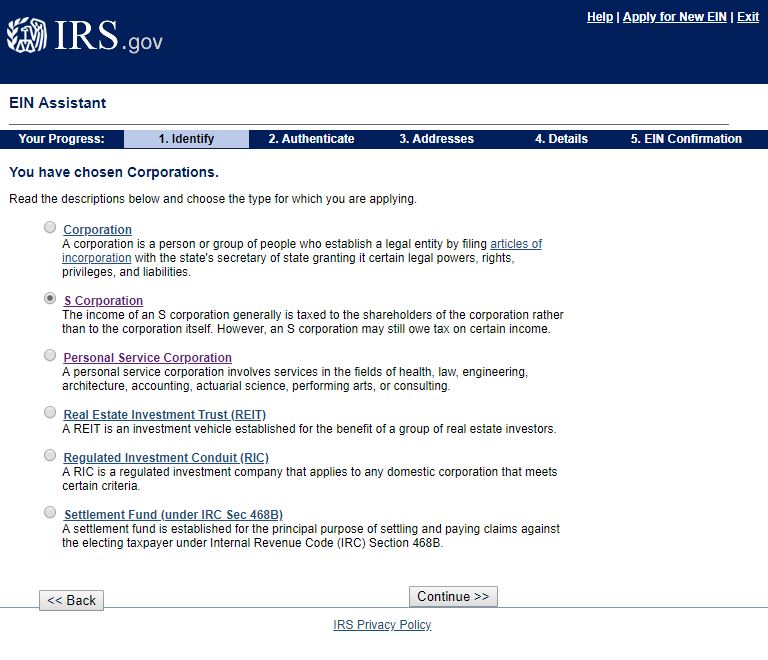

An s corporation should obtain what is known as an employer identification number (ein), also called a federal tax id number.

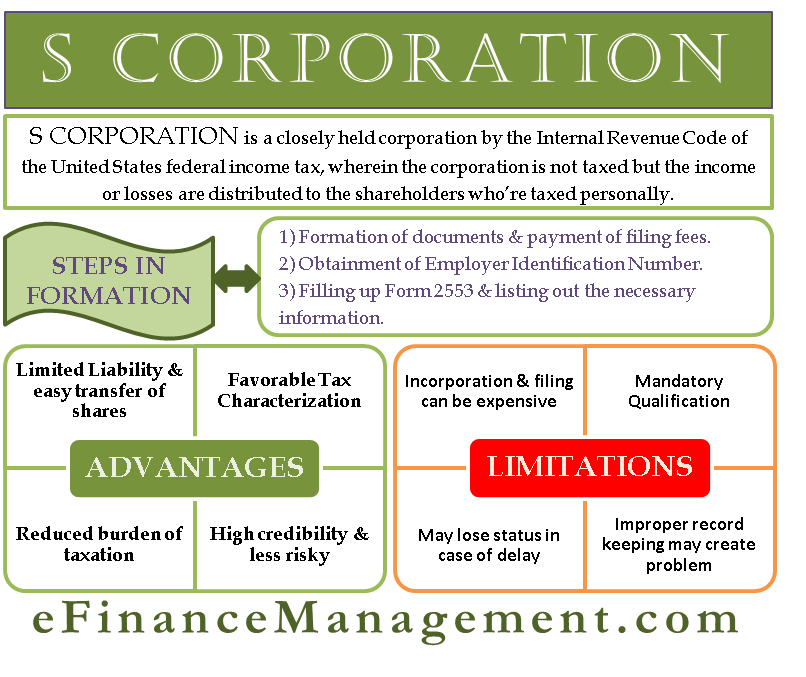

How to apply for s corp. An s corporation begins its corporate existence similar to a c corporation and articles of incorporation must be prepared and filed with the state office. Ad find the right registered agent for your business' needs, we compared the best options. Once your llc or c corporation formation is approved by the state, you need to file form 2553,.

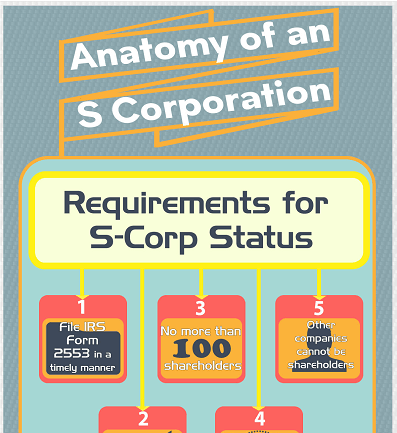

File the form to apply for s corp status. Unlike a c corporation, each year a shareholder's stock and/or debt basis of an s corporation. To ensure the application process goes as smoothly as.

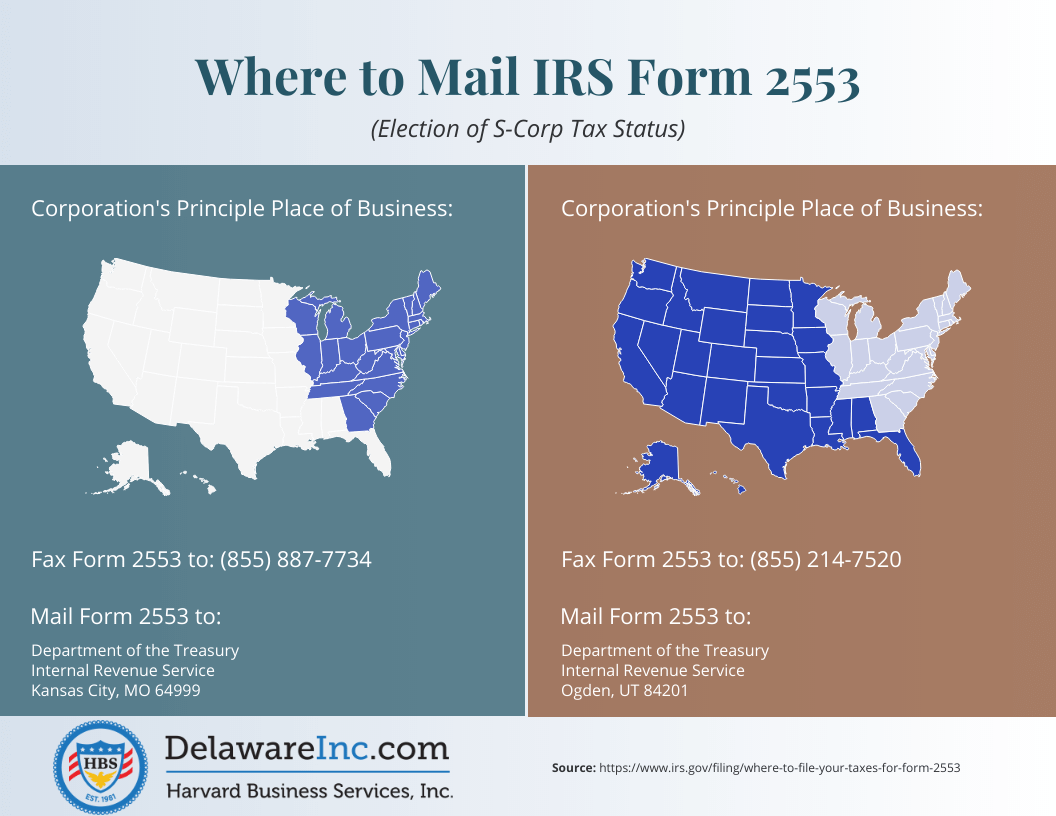

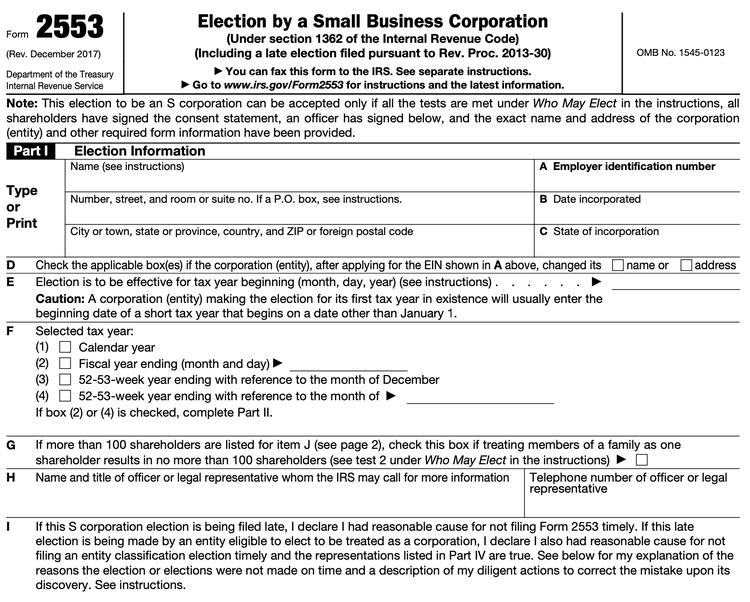

The amount of a shareholder's stock and debt basis in the s corporation is very important. A small business corporation elects federal s corporation status by filing federal form 2553 (election by a small business corporation) with the internal revenue service. Ad file your s corporation today.

If you meet the irs requirements, you can complete form 2553, election by a small business corporation through the irs. Be fully registered with the nj division of. How to apply for s corporation status.

A small business corporation elects federal s corporation status by filing federal form 2553 (election by a small business corporation) with the internal revenue service. A corporation generally takes the same. Additionally, s corp owners must file an election form with the irs that allows the business to pass its deductions, losses, credits, and income through to its shareholders, eliminating the.

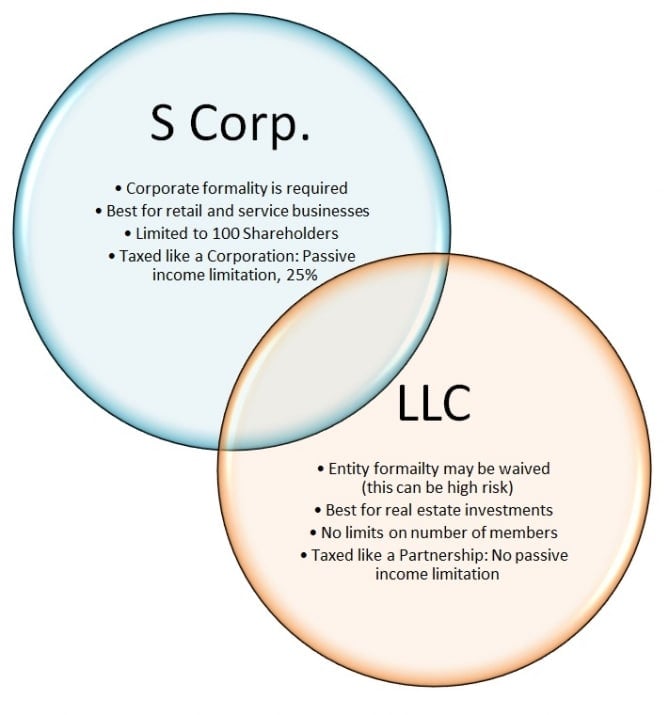

In forming a corporation, prospective shareholders exchange money, property, or both, for the corporation's capital stock. Should an s corporation apply for a federal tax id? Income, losses, deductions, and credits flow through to the shareholders,.

:max_bytes(150000):strip_icc():gifv()/Subchapters_final-4bfb9205ebb24a948b3f448fae293102.png)