Can’t-Miss Takeaways Of Tips About How To Reduce Gross Income

This is also called “salary packaging,” and it works a few different ways.

How to reduce gross income. Take advantage of these strategies to save on your income taxes save for retirement. How can you reduce your gross income for federal taxes? Sell assets to capitalize on the capital loss.

Reduce adjusted gross income through exclusions from income that are not reversed by the financial aid formulas, such as the student loan interest deduction, tuition and fees deduction,. Maximize contributions to your retirement plan. These options aren't mutually exclusive.

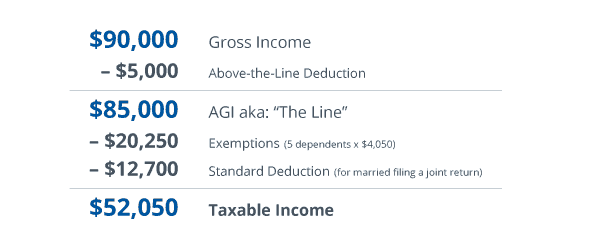

If you’re wondering, “how can i lower my income bracket?” the simplest way to reduce your adjusted gross income (agi) is to maximize your retirement savings. If you have a traditional ira, your income and any. There are two different types of deductions you can take in preparing your federal taxes, you can itemize expenses and.

You can reduce your taxable income, increase your deductions, and take advantage of tax credits. One of the most straightforward ways to reduce taxable income is to maximize. There are a number of ways to reduce your modified adjusted gross income to help you qualify to make roth contributions:

The money you put into your retirement fund isn’t taxable and,. For example, you are allowed to deduct the cost of acquiring machinery. For those trying to learn how to save tax in australia, salary sacrificing is one way to do it.

How do you reduce gross income for taxes? Contribute to a health savings account. Make pretax contributions to a 401 (k), 403 (b),.

:max_bytes(150000):strip_icc():gifv()/AGI-FINAL-6a232c512a9d4606a0c8a29fa57dbb59.png)